Are Tax Cuts the Big Break the Economy Needs Right Now?

- Navya Holla

- Feb 20, 2025

- 5 min read

Updated: Aug 22, 2025

On February 1st, Finance Minister Nirmala Sitharaman delivered the Union Budget for 2025, as millions of Indians listened eagerly in hopes for measures to reignite the country’s sluggish economic growth. The government’s approach was clear: tax cuts were the key lever to revive an economy struggling with declining consumer activity. This was done primarily by lifting the income tax exemption threshold by Rs 5 lakh, up from Rs 7 lakh to Rs 12 lakh, exempting an additional 10 million Indians from paying taxes, leading to projected foregone revenues of around Rs 1 Lakh Crore.

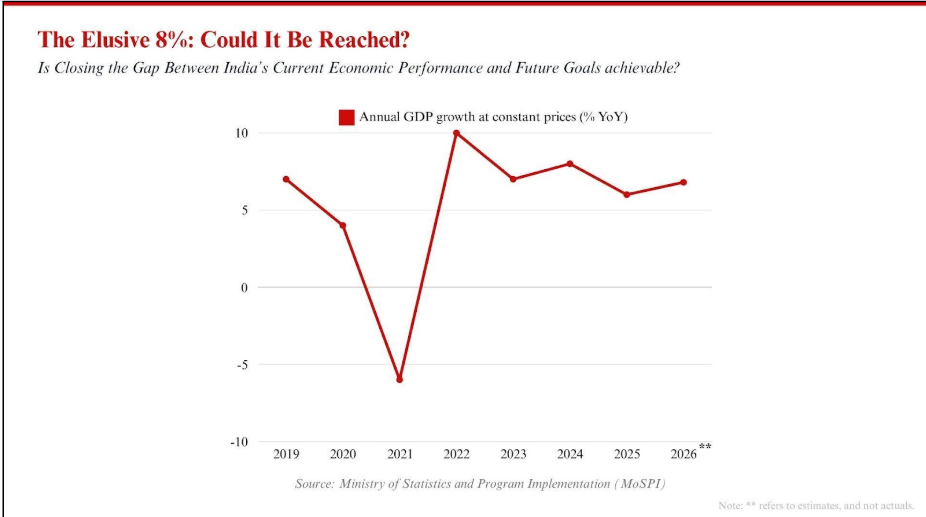

The reason for this? Waning consumer spending. Economic growth hasn’t met expectations– hovering around a projected 6.4% for FY25, and between 6.3%- 6.8% for FY26. These figures fall short of Modi’s big goals of “Viksit Bharat”– or a developed India by 2047. Achieving this goal means a sustained GDP growth of 8% over the next two decades. Added to this, are the looming geopolitical threats of tariffs from Trump’s administration, which could potentially dampen India’s exports, further denting GDP figures.

Given their well-established mechanisms in economic theory, tax cuts are relatively straightforward on paper– leave people with more incomes and encourage them to spend more, driving up the aggregate demand. As KV Subramanian, Executive Director, IMF argues, increased disposable incomes of Rs 1 lakh crore among the middle class could boost consumption by Rs 5 lakh crore, triggering the multiplier effect, and push YoY growth beyond 8%. But how effective is a tax cut in an economy like India’s where an estimated 90% of the workforce operates within unregistered and informal settings whose earnings aren’t fully accounted for? In 2024, around 7.28 crore people filed Income Tax Returns (ITR). A large number, no doubt. But when you compare this to India’s 1.4 billion population, this is just around 5%. And those who do end up paying, account for a meager 2-3% of India’s population. As Swaminathan Aiyar, Editor at ET Now warns, raising the tax exemption limit shrinks the taxpayer pool, which could negatively affect government revenues, presenting additional risks especially amid uncertain U.S Trade policies. One thing is for sure– this is a bold gamble.

The primary beneficiaries of tax reforms are generally those who lie higher on the income ladder, and are more inclined to save more and consume less. The theory of the Marginal Propensity to Consume (MPC) argues that as incomes rise, the additional income is less likely to be spent on consumption. So would tax breaks be that effective in stimulating consumer spending, and ultimately consumer demand? How do we stimulate the spending patterns of workers in Informal sectors whose earnings are harder to record? And finally, what about the unemployed? As Shashi Tharoor, a Congress MP, points out, "To benefit from income tax relief, you actually need jobs".

Inadequate Job Creation & Wage Stagnation

Despite claims from the Ministry of Labor and Employment of increased Employee’s Provident Fund Organization (EPFO) registrations, this isn’t necessarily reflective of new job creation and has mostly been driven by the formalization of already employed contract laborers. In reality, there hasn't been much development on the job front. One report by ILO in March 2024 on India’s labor market indicated that highly educated young workers were most likely to be unemployed– jobless rates among graduates were almost nine times higher than that of their illiterate counterparts, standing at around 29.1%, alluding to inconsistencies in the demand-supply dynamics governing labor markets, and the inability of job creation to keep up with GDP growth. Such is the pessimism around the macroeconomic state of India, that household expenditure (PCE), which contributes more than 60% of GDP has dropped. Households have cut down on consumption, denting investment outlooks for companies operating in the consumer goods sector. Something needs to be done to stimulate the economy and restore the “Animal Spirits”, as Keynes described it.

Can India Afford This?

It seems that the government is banking on increasing consumer activity as a key driver of this growth.

While households certainly welcome the tax relief, economic analysts don’t meet this with the same enthusiasm. With an 8% decline in direct income tax revenue despite its ambitious goals, the government must ensure fiscal sustainability. Despite India’s efforts to reduce its fiscal deficit (% GDP) from 9.2% in FY21 to around 5.1% in FY25, with projections of 4.4% for the current fiscal year, analysts seem to be worried about the declining revenues, and India’s ability to manage its debt obligations. India's debt-to-GDP ratio stands just above 80%, significantly higher than the 50-60% range typical for countries with similar ratings. This makes a sovereign rating upgrade in the near future unlikely. India currently has a BBB- rating by S&P and Fitch, which also happens to be the lowest investment grade rating. Better ratings could potentially lead to favorable borrowing costs for governments and businesses as well as raise investor confidence.

The Takeaway

Tax cuts are, without a doubt, an effective short-term policy measure to aid in growth– by increasing consumer spending and investment. Its effectiveness however, depends on the way it’s being used. Tax reliefs aren’t going to help stimulate growth if the beneficiaries end up saving the additional income. And if they do end up spending it, how much of the money is being fueled into domestic goods and services?. In an economy like India with an already small taxpayer population, further shrinking these numbers may not achieve the long-term growth it desires. There is, however, a solution. In addition to this short-term stimulus, India can also benefit from policies targeted at addressing structural factors. This could be achieved by formalizing the workforce, increasing infrastructure spending, and cutting the red tape– achieving sustained growth by creating better jobs. Stay tuned for Part 2, where we’ll explore the other ways India could achieve its goals.

Bibliography

[1] Reuters Staff. “India’s Economy Faces Slowing Growth, Volatile Trade ahead of New Financial Year.” Reuters, 29 Jan. 2025, www.reuters.com/world/india/indias-economy-faces-slowing-growth-volatile-trade-ahead-new-financial-year-2025-01-29/.

[2] Harriss-White, Barbara. “India’s Informal Sector - the Feeder Economy Within.” Thehinducentre.com, 29 Oct. 2024, www.thehinducentre.com/the-arena/current-issues/indias-informal-sector-the-feeder-economy-within/article68786567.ece.

[3] Reuters. “India’s Rating Upgrade a Challenge as Debt Woes Trump Fiscal Prudence, Says Fitch.” The Economic Times, Economic Times, 3 Feb. 2025, economictimes.indiatimes.com/news/economy/indicators/indias-rating-upgrade-a-challenge-as-debt-woes-trump-fiscal-prudence-says-fitch/articleshow/117881116.cms?from=mdr. Accessed 5 Feb. 2025

[4] ET Online. “FMCGs, Beware! The Coming Year Could Be Another Hurdle for India’s Consumer Market.” The Economic Times, Economic Times, 13 Dec. 2024, economictimes.indiatimes.com/industry/cons-products/fmcg/fmcg-companies-concerns-demand-slowdown-in-indian-economy-the-coming-year-could-be-another-hurdle-for-indias-consumer-market/articleshow/116284459.cms?from=mdr.

[5] Franklin Templeton Global Investment Outlooks

[6] UBS. “Is There a Link between Emotions and Economic Outcomes?” Nobel Perspectives, 30 June 2022, www.ubs.com/microsites/nobel-perspectives/en/latest-economic-questions/success/articles/emotional-economics.html.

[7]Now, ET. “Budget 2025 Tax Cuts Could Trigger Consumption Multiplier and Lead to 8% GDP Growth Rate: KV Subramanian,.” The Economic Times, Economic Times, 3 Feb. 2025, economictimes.indiatimes.com/markets/expert-view/budget-2025-tax-cuts-could-trigger-consumption-multiplier-and-lead-to-8-gdp-growth-rate-kv-subramanian-imf/articleshow/117837365.cms. Accessed 6 Feb. 2025.

[8] Now, ET. “Budget 2025: Tax Sops for Middle Class Too High & Shrinks Tax Base; No Mention of Capex, Trump Threat: Swa.” The Economic Times, Economic Times, Feb. 2025, economictimes.indiatimes.com/markets/expert-view/budget-2025-tax-sops-for-middle-class-too-high-shrinks-tax-base-no-mention-of-capex-trump-threat-swaminathan-aiyar/articleshow/117823748.cms. Accessed 6 Feb. 2025.