Effects of Trump win on Indian Economy

- Avik Reengusia

- Nov 17, 2024

- 3 min read

How Donald Trump’s 2024 Victory Could Impact the Indian Economy

With Donald Trump securing the presidency in 2024, the economic ripple effects for India are already being hotly debated. During his first term, Trump’s policies shaped everything from trade to immigration in ways that significantly impacted the Indian economy, and a second term seems poised to bring both challenges and opportunities.

Visa Restrictions and IT Job Implications

One of Trump’s most controversial moves during his earlier presidency was his restriction on H-1B visas, directly impacting the Indian IT sector, which relies heavily on skilled workers in the U.S. According to a report by Nasscom, these restrictions affected over 70% of Indian H-1B visa applicants, resulting in significant revenue hits for major Indian IT firms like Infosys and TCS. With Trump now back, industry experts are concerned about the possible reintroduction of these stringent measures. A report by Livemint points out that, if reinstated, this could mean “job cuts or stagnant hiring for tech professionals in India,” potentially impacting the $194 billion Indian IT industry heavily reliant on U.S. clients. To illustrate, Trump’s previous tenure saw Indian tech stocks dip on visa-related announcements.

Gautam Adani commented in a recent tweet that “Trump’s policies on immigration and trade could create both hurdles and openings for India’s tech workforce and economy.” His view echoes widespread sentiment in the sector, as another round of restrictive visa policies could reduce growth and lead to more outsourcing being done from within India.

Trade Relations: More of the Same?

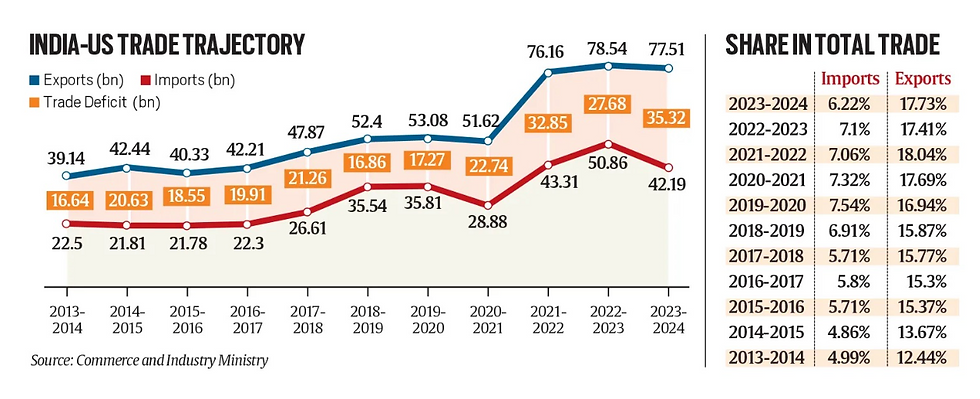

Trump’s “America First” policy previously fueled tariff wars, impacting goods from India. The Federation of Indian Export Organisations reported a 30% drop in exports of goods like textiles and handicrafts to the U.S. due to the 2018 tariff changes. Now, with the resurgence of Trump, Moody’s report indicates that the U.S. may again employ protectionist policies that could make Indian exports costlier.

According to economists, India’s trade deficit with the U.S. could deepen if these policies are implemented. In fact, Adani also hinted at potential “allyship” with U.S. industries, which may lead to more investments in critical sectors like defense and manufacturing. These partnerships might soften the blow of increased tariffs on goods while aligning India with sectors that the U.S. prioritizes.

Investment Impacts and Stock Market Sensitivity

Trump’s re-election isn’t all doom and gloom for India, though. The Indian stock market’s reaction to his 2016 win was initially volatile, but it eventually stabilized as investors assessed the trade impact and favorable reforms. According to a Business Standard report, the markets this time around are expected to adjust more swiftly, particularly with Indian companies already diversifying their U.S.-oriented portfolios. However, there are still potential risks to Indian markets, especially if Trump’s policies trigger capital outflows from emerging markets like India to U.S.-based securities.

Moreover, Trump's infrastructure-centric policies could present opportunities for Indian companies in construction and raw materials. In his first term, construction stocks in India surged following announcements of large-scale U.S. infrastructure projects, leading to expectations of a similar trend now.

The Indian Debt Market: Prepared or Vulnerable?

Interest rate adjustments by the U.S. Federal Reserve in response to Trump’s fiscal policies could also have implications for Indian debt markets. In 2017, when the Fed raised interest rates, India saw significant foreign capital outflow. Economists suggest that this might occur again, as Trump’s policies could compel the Fed to enact rate hikes, making U.S. assets more attractive to investors. Business Standard noted that “if the Fed pursues aggressive rate hikes, the Indian rupee might see further depreciation,” which could, in turn, increase India’s import costs, especially for crude oil.

Geopolitics and Energy Dependency

The geopolitical relationship between the U.S. and China also remains a point of interest for India. Trump’s hard stance on China could again benefit India as a viable alternative for trade and manufacturing. During his previous tenure, tensions between the U.S. and China led to more tech and manufacturing firms diversifying into India. If this rivalry persists, India might once again find itself in a favorable position to attract foreign investment, particularly in the manufacturing sector, aligning with the government’s “Make in India” initiative.

However, India’s energy dependency on the U.S. could be a double-edged sword. India imports a substantial portion of its energy needs, and any hike in U.S. energy prices could strain India’s fiscal balance. Past events have shown that India’s energy sector remains vulnerable to such geopolitical shifts, with crude oil prices expected to fluctuate as the U.S.-China rivalry intensifies.

A Balancing Act for the Indian Economy

Trump’s policies will require India to navigate both risks and opportunities, especially within the tech, trade, and energy sectors. As the dust settles on Trump’s return, India's economy will likely adapt, driven by data-backed decisions and strategic collaborations. Whether Trump’s presidency proves to be a boon or a bane, one thing’s certain: the Indian economy is in for a dynamic ride.